What Is The Federal Standard Deduction For 2025

What Is The Federal Standard Deduction For 2025. Standard deductions are deducted from your taxable income automatically when you prepare and efile your taxes. · the estate tax exemption will be.

For example, if the standard deductions are greater than your taxable income, you would not have taxes due. · the standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (ctc) will be cut.

Though Barely 100 Years Old, Individual Income Taxes Are The Largest.

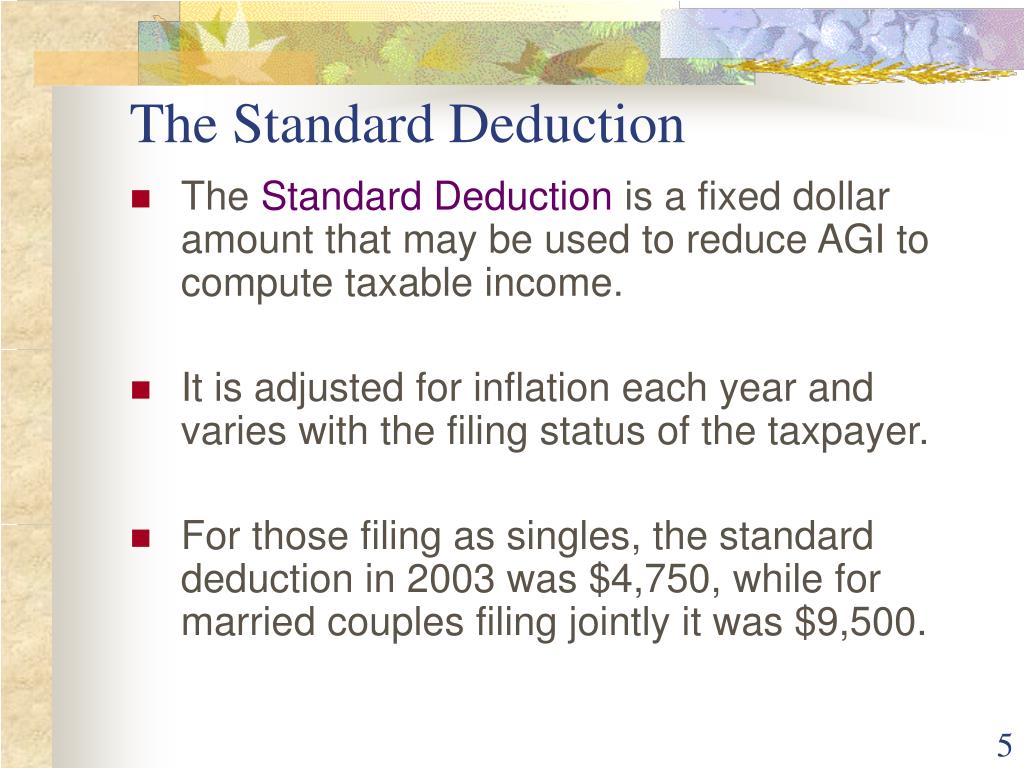

The standard deduction is a fixed dollar amount that reduces your taxable income.

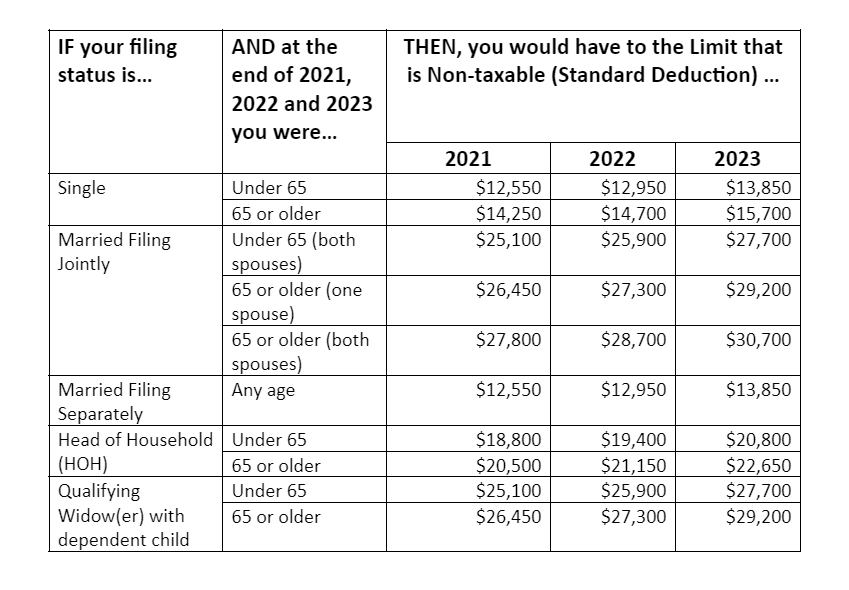

For 2023, The Federal Standard Deduction For Single Filers Was $13,850, For Married Filing Jointly It Was $27,700 And For The Head Of Household Filers, It Increased To $20,800.

The top tax rate is 37% for returns filed by individual taxpayers for the 2025 tax year, which are filed in 2025.

What Is The Federal Standard Deduction For 2025 Images References :

Source: twitter.com

Source: twitter.com

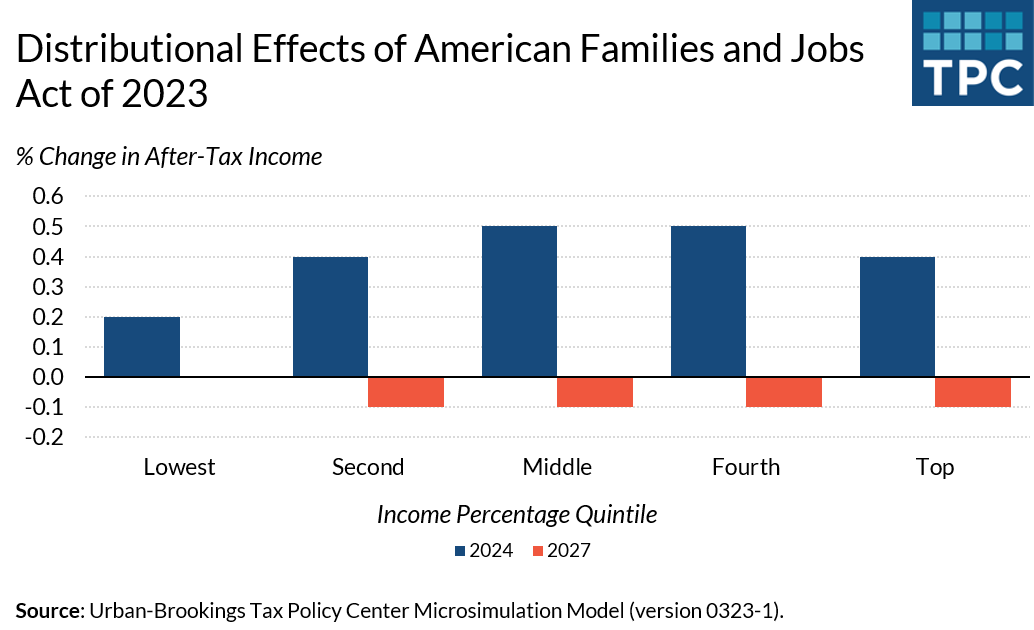

Tax Policy Center on Twitter "A House GOP tax plan would raise the, The tax cuts and jobs act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025. · the estate tax exemption will be.

Source: www.hantzmonwiebel.com

Source: www.hantzmonwiebel.com

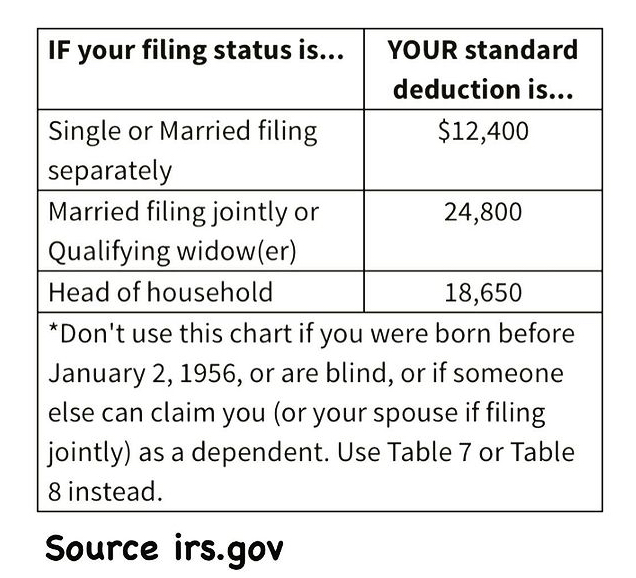

10 Tax Elections to Save Money on Your 2019 Return Hantzmon Wiebel, The standard deduction is a fixed dollar amount that reduces your taxable income. The additional standard deduction amount for 2025 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

Source: www.slideserve.com

Source: www.slideserve.com

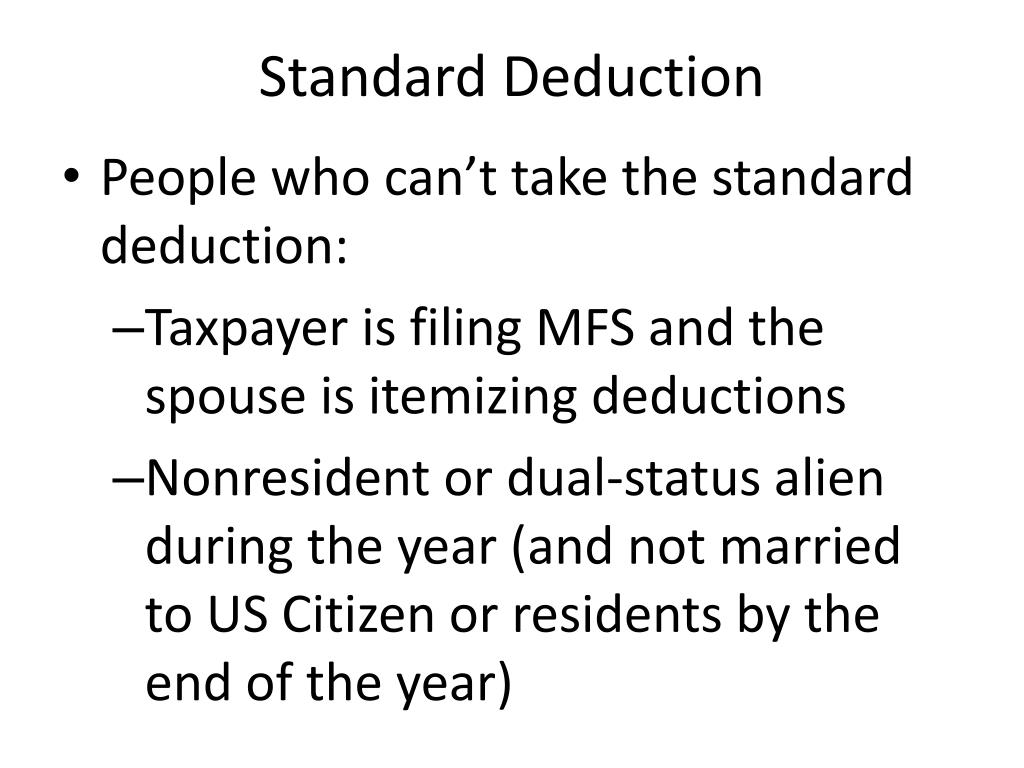

PPT Standard Deduction & Itemized Deductions PowerPoint Presentation, More than 90% of taxpayers take the standard deduction, ed slott says. The expiration includes increasing individual income tax rates, lowering the standard deduction, reducing the child tax credit, and changes to the alternative.

Source: felipaqchristabel.pages.dev

Source: felipaqchristabel.pages.dev

Standard Federal Tax Deduction For 2025 Cati Mattie, The expiration includes increasing individual income tax rates, lowering the standard deduction, reducing the child tax credit, and changes to the alternative. The standard deduction will drop but personal exemptions and unlimited salt deductions are coming back.

Source: knowbetterplanbetter.com

Source: knowbetterplanbetter.com

What Is Standard Tax Deduction? · Know Better Plan Better, Tax rates are going up after 2025. The standard deduction will drop but personal exemptions and unlimited salt deductions are coming back.

Source: lcltaxbd.com

Source: lcltaxbd.com

Filing Status and Standard Deductions for U.S. Citizens London, It also eliminated the “pease” limitation on itemized deductions for those. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill.

Source: josieqmaribeth.pages.dev

Source: josieqmaribeth.pages.dev

Tax Brackets And Standard Deductions 2025 Sib Lethia, The federal income tax was established in 1913 with the ratification of the 16th amendment. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns.

Source: ateam.tax

Source: ateam.tax

Standard or Itemized Deduction ATEAM TAX & ACCOUNTING, The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (ctc) will be cut. Tax rates are going up after 2025.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Chapter 14 PowerPoint Presentation, free download ID1354218, The standard deduction, tax bracket ranges, other deductions, and phaseouts are. The standard deduction is generally a fixed dollar amount, adjusted each year for inflation, that reduces the taxpayer’s taxable income.

Source: www.youtube.com

Source: www.youtube.com

Itemized Deduction vs. Standard Deduction, Explained. YouTube, For 2023, the federal standard deduction for single filers was $13,850, for married filing jointly it was $27,700 and for the head of household filers, it increased to $20,800. The federal income tax was established in 1913 with the ratification of the 16th amendment.

Your Standard Deduction Consists Of The Sum Of The Basic.

This change will be either positive or negative.

The Standard Deduction Will Be Cut Roughly In Half, The Personal Exemption Will Return While The Child Tax Credit (Ctc) Will Be Cut.

Itemized deductions can also reduce your taxable income, but the amount.

Category: 2025